does wyoming charge sales tax on labor

If that was the only job you did all quarter when you Web File your sales tax return you will show the. See the publications section for more information.

Transportation or delivery charges paid by the Wisconsin purchaser to a carrier which is independent of the seller.

. You can find more information above. Under certain circumstances labor charges are taxable. Richardson Company 247 So2d 151 La.

Labor to fabricate or repair movable property is taxable. As of December 2019 the Wyoming DOR offers a discount of 195 on the first 6250 and 1 on any remaining remittance. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

Does Wyoming charge sales tax on vehicles. You then bill your customer 100 for materials 200 for labor for a total of 300 and charge your customer 24 in sales tax 300 x 8. To learn more see a full list of taxable and tax-exempt items in Wyoming.

This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but. Services admission fees or personal tangible property. No you do not pay sales tax on labor.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1354 for a total of 5354 when combined with the state sales tax. Services are subject to sales tax in a number of states. In the event the vendor does not collect the sales tax the department may seek to collect the sales tax from the vendor or the purchaser.

The maximum local tax rate allowed by Wyoming law is 2. In Wyoming you need a resellers or sales tax certificate if you sell or will sell any physical merchandise. This page describes the taxability of services in Wyoming including janitorial services and transportation services.

Does minnesota charge sales tax on labor. Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

Sales Tax Exemptions in Wyoming. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

You can look up the local sales tax rate with TaxJars Sales Tax Calculator. This page discusses various sales tax exemptions in Wyoming. Lump sum The construction company figures up the cost of all parts materials and labor and then charges the buyer in one lump sum.

This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. There are several exemptions to the state sales. In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and.

To be considered a vendor you must participate in wholesale or retail sale of any of the following items that are taxed. Do you charge sales tax for services in Texas. Wyoming does have a sales tax which may vary among cities and counties.

For additional information on these sales and services see Publication 201 Wisconsin Sales and Use Tax Information. The sales price of direct mail does not include separately stated delivery charges. Oklahoma does not provide an exemption from sales and use tax for materials or equipment used in the production of oil and gas.

Wyoming Use Tax and You. There is a maximum of 500 per filing period per vendor. Additionally Oklahomas manufacturing exemption provided by Okla.

Labor charges to install or repair items that become part of real estate are not taxable. The state sales tax rate in Wyoming is 4. Taxability varies by state and is influenced by the delivery method whether.

68 135215 states that extractive and field processes for oil and gas production are not deemed to be manufacturing processes. The vehicle was a taxable item hence labor to repair it is taxable This would also apply to appliances jewelry and any other taxable items. However sales tax will apply only to charges for labor or services rendered in installing or applying taxable tangible personal property digital property or service sold at retail.

Many states encourage the timely or early filing of sales and use tax returns with a timely filing discount. State wide sales tax is 4. The Excise Division is comprised of two functional sections.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Are services subject to sales tax in Wyoming. Time and materials In this billing method the.

Labor charges to construct or repair immovable or real property are not subject to sales tax. The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services. In 2022 ecommerce sales worldwide are expected to exceed 5 trillion for the first timeIf youre part of that rising tide you need to know how to tax shipping and delivery charges.

There are two main methods. Just as theres no one way to get products into the hands of customers theres no one way to tax delivery charges. Pennsylvania for example charges tax on numerous services including but not limited to lobbying services secretarial or editing services and building maintenance or cleaning services.

Stand-alone labor and installation services are not subject to sales and use tax unless specifically enumerated in KRS 139200 see next section. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

An example of taxed services would be one which sells repairs alters or improves tangible physical property. 1971 and by the definition of dealer under LAC 61I4301. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

This issue is addressed in the court case Collector of Revenue v. First of all whether or not a construction company collects sales tax often depends on how that company charges for the job. In some cases this can be an advantage because any markup you charge to your customer on the materials supplies and labor wont be subject to sales tax.

Fees for labor are taxed when the labor is expended on a taxable item ie repairs to a vehicle. An example of an item that exempt from Oklahoma is prescription medication.

Virginia Labor Law Poster 2021 Replacement Service Va Labor Law Posters

Kentucky Sales Tax Small Business Guide Truic

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

_edited.png)

Local Grants Goshen Economic Dev

Creative Recruiting Ideas For Manufacturing During Covid 19 Wipfli

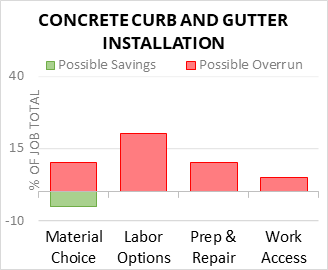

Cost To Install Concrete Curb And Gutter 2022 Cost Calculator Customizable