greenville county property tax estimator

Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or something else.

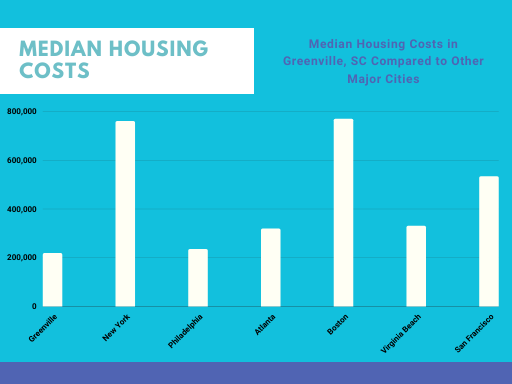

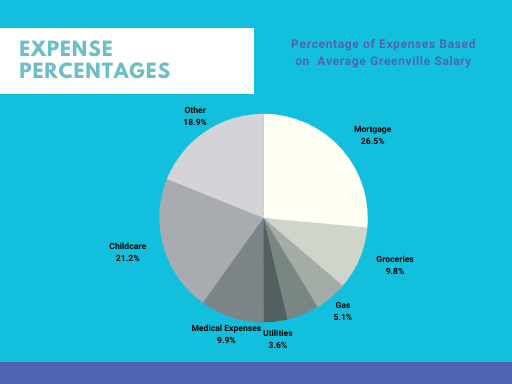

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Get driving directions to this office.

. For an estimation on county taxes please visit the Greenville county or Laurens county. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by. Property tax is calculated by multiplying the propertys assessed value by the total milage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair. Welcome to the Greenville County Geographic Information Systems GIS homepage. Greenville County South Carolina.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. The median property tax on a 13750000 house is 68750 in South Carolina. The median property tax on a 13750000 house is 144375 in the United States.

Enter the first 3 fields to calculate your estimated vehicle tax. 864 467 7300 Phone 864 467 7440 Fax The Greenville County Tax Assessors Office is located in Greenville South Carolina. Tax Collector Suite 700.

The countys average effective rate is 069. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. The Tax Estimator is designed to provide an estimated range on property tax for a Vehicle Camper or Watercraft in Greenville County.

Yearly median tax in Greenville County. The largest tax in. Counties in South Carolina collect an average of 05 of a propertys assesed fair market value as property tax per year.

Tax amount varies by county. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Greenwood County Tax Estimator South Carolina SC.

On Sunday April 24th. Tax Year 2022 Estimated Range of Property Tax Fees 0. The Greenville County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Learn all about Greenville County real estate tax. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. The median property tax on a 14810000 house is 155505 in the United States.

2500 Stonewall Street Suite 101 Greenville TX 75403. The median property tax on a 14810000 house is 74050 in South Carolina. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Please Note The Tax Estimator DOES NOT include DMV fees. The median property tax in South Carolina is 68900 per year for a home worth the median value of 13750000.

South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median. Find the best County property tax estimator around GreenvilleSC and get detailed driving directions with road conditions live traffic updates and reviews of local business along the way. This tool is helpful for those looking to purchase a home inside the City limits of Fountain Inn or those interested in annexing their home into the City limits.

The median property tax on a 14810000 house is 97746 in Greenville County. 903 408-4001 Chamber of Commerce Office 1114 Main St. Greenwood County Tax Estimator South Carolina SC.

Due to scheduled maintenance all online payment processing may be briefly unavailable between 3 am. The Tax Estimator should be considered only as an estimate. Greenville South Carolina 29601.

Lexington County Administration Building is open to the Public Monday - Friday from 800 am. The rates are expressed as millages ie the actual rates multiplied by 1000. SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties.

The Greenville County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Greenville County. Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Search for Voided Property Cards.

This tool is meant to help estimate the City taxes owed for a one year term based on the estimated value of a home. South Carolina has one of the lowest median property tax rates in the United States. 301 University Ridge Suite 1000.

County functions supported by GIS include real estate tax assessment law enforcement. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations.

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

Taxes Greenville Area Development Corporation

Greenville Sc Cost Of Living Is Greenville Affordable Data

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Why Land Values Are Rising In Greenville County South Carolina

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Greenville County Assesses Taxes The Home Team

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Traveling For The Holidays Make Sure You Stay Safe On The Roads Autoautoinsurancecar Carinsurance Conn Winter Driving Tips Winter Driving Holiday Road Trip

Pickens Sc Homes For Sale And Real Estate In Pickens Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Williams Gr Real Estate Estates Lake Keowee