california sales tax payment plan

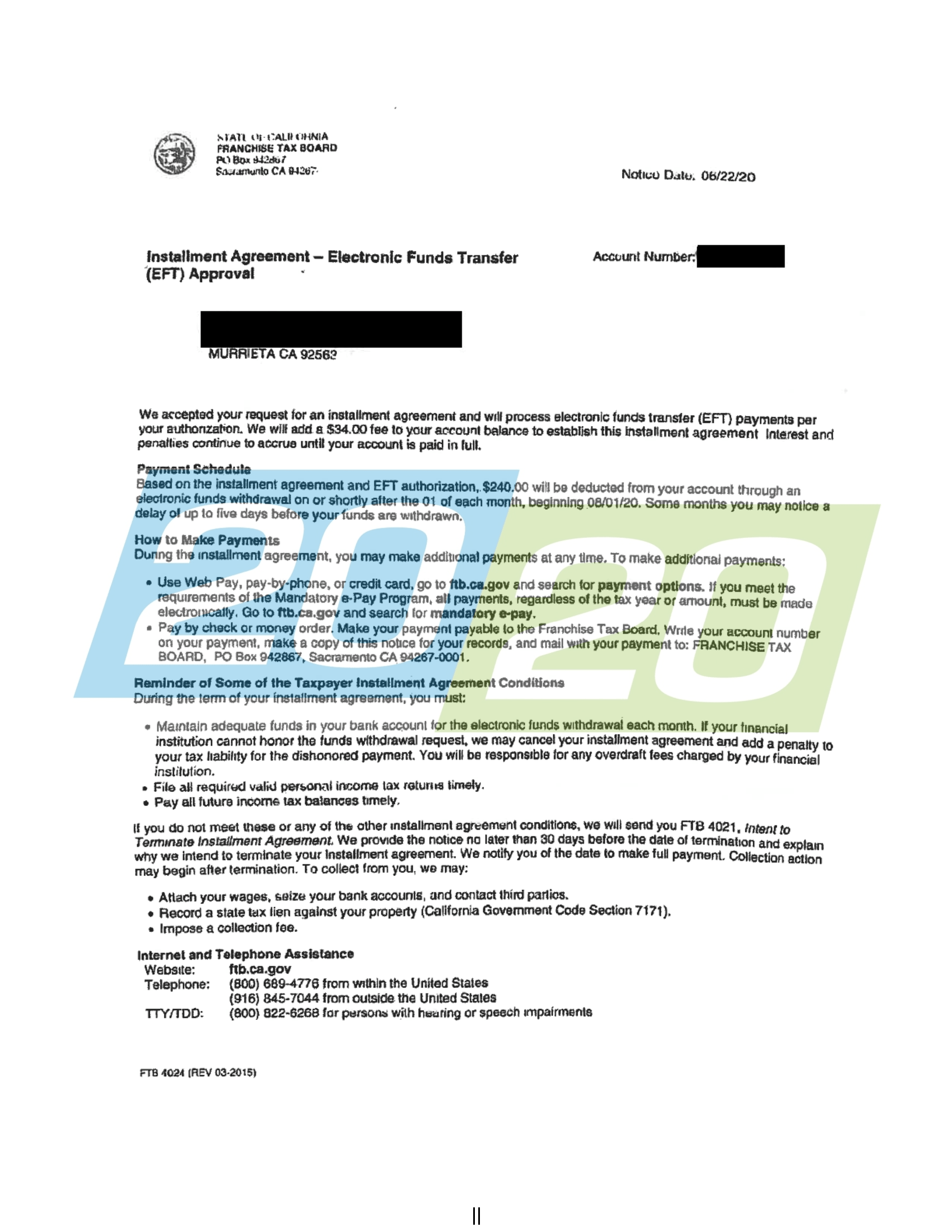

Make monthly payments until my tax bill is paid in full. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

No More Sales Taxes On Diapers And Tampons Under Gov Gavin Newsom S Proposed Budget Los Angeles Times

To change your current installment agreement call us at 800 689-4776.

. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. For help with determining how to respond to. Pay by automatic withdrawal from my bank account.

To be eligible the amount owed must be less than 25000. Breaking news about California offering 12-month sales tax payment plans to small businesses impacted by the COVID-19 pandemic. Effective April 2 2020 small businesses with less than 5 million in taxable annual sales.

It may take up to 60 days to process your request. Businesses impacted by recent California fires may qualify for extensions tax relief and more. A payment plan will cost 34 to set up added to your balance.

This is only an extension on time to file not pay. Please visit our State of Emergency Tax Relief page for additional information. Pay a 34 setup fee that will be added to my balance due.

Effective April 2 2020 qualified small businesses can take advantage of a sales tax payment. Please visit our State of Emergency Tax Relief page for additional information. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax.

You can register online for most sales and use tax accounts and special tax and fee programs. For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12-month. You may be required to pay electronically.

Pay including payment options collections withholding and if you cant pay. You will receive an acceptance letter within 90 days. Wisconsin businesses can request to pay sales and use tax returns due April 30 2020 by June 1 2020 instead.

California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19. Under the Payments section select Request a Payment Plan to begin your request. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19.

Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax. Simplified income payroll sales and use tax information for you and your business. Change your payment amount or.

Common reasons to change or cancel. Keep enough money in. Simplified income payroll sales and use tax information for you and your business.

For the approximate 995 of business taxpayers below. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

Businesses with 5 million or more in annual taxable sales in sectors particularly impacted by operational restrictions due to the pandemic may also apply for this 12-month interest-free. Change or cancel a payment plan. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF.

A Sellers Permit is issued to business owners and allows them to.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Of California Income Tax Rates Youtube

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Free Payment Plan Agreement Template Word Pdf Eforms

Apply Online For A Payment Plan Individuals Ftb Ca Gov

California Plans To Double Taxes Get Your Plan B Now Htj Tax

Changing Plans Flexibility Accountability And Oversight Of Local Option Sales Tax Measure Implementation In California Ucla Institute Of Transportation Studies

Mandate Individual Shared Responsibility Isr Penalty California

How To Request A Payment Plan Youtube

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Set Up A Payment Plan With The Irs In California

Advice About Setting Up A Payment Plan With The State Of California

Apply Online For A Payment Plan Individuals Ftb Ca Gov

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

Ca Homeowners Here S How The Gop Tax Plan Might Affect You Kpcc Npr News For Southern California 89 3 Fm